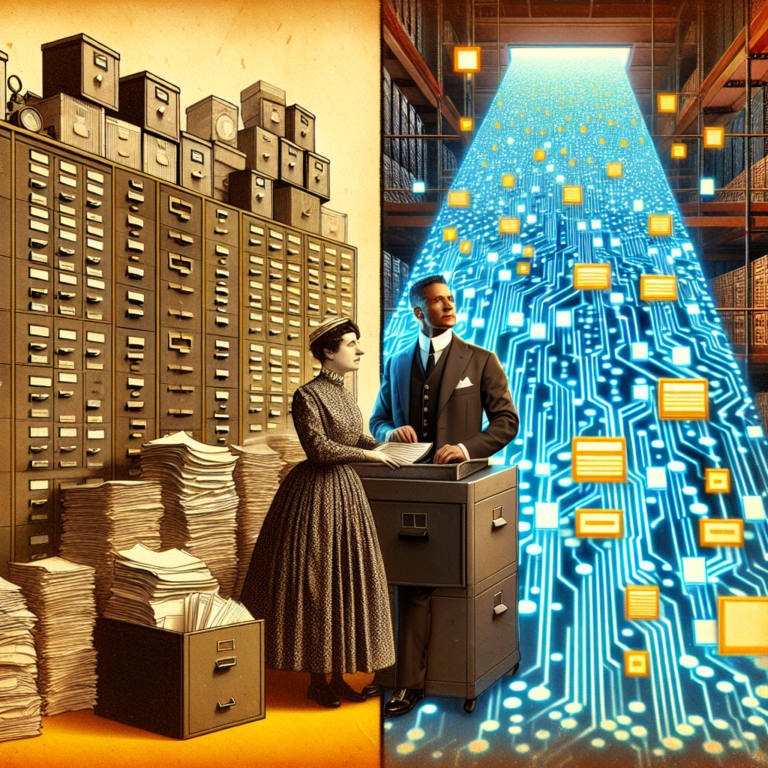

In an age where digital technology permeates every facet of our lives, the legal and financial sectors are undergoing profound transformations. One of the most significant shifts in recent years is the transition from traditional paper-based lien recording to electronic lien recording (ELR). This evolution is not merely a trend but a fundamental change aimed at improving efficiency, security, and accessibility in the management of liens.

Understanding Liens and their Importance

A lien is a legal claim or right against assets that are typically used as collateral to satisfy a debt. Liens play a crucial role in various transactions, such as real estate dealings and vehicle purchases. They protect creditors’ interests and inform potential buyers of the financial obligations tied to the asset. As businesses and individuals navigate the complexities of these transactions, the integrity and efficiency of lien recording become pivotal.

The Burden of Paperwork

Historically, lien recording was a cumbersome process that involved mountains of paperwork. Each lien had to be meticulously documented, often requiring physical signatures, notarization, and filing with governmental offices. This process not only consumed time but was also prone to errors—whether due to misfiled documents, lost papers, or data entry mistakes. The result was a slow, inefficient system that hindered real estate transactions and credit flows, potentially putting businesses and consumers at risk.

The Emergence of Electronic Lien Recording

The advent of electronic lien recording systems has revolutionized how liens are managed. By digitizing the process, stakeholders can now submit, track, and manage lien documents from anywhere, drastically reducing the time it takes to record a lien. Here are some of the core benefits driving the shift towards ELR:

1. Efficiency and Speed

One of the most appealing aspects of electronic lien recording is its ability to streamline processes. With a few clicks, lenders and title companies can submit lien documents, often receiving immediate confirmation of recording. This contrasts sharply with the traditional method, where submissions might take days or even weeks to process. Faster recording times enhance liquidity and facilitate quicker transitions in asset ownership.

2. Cost Reduction

Reducing reliance on paper not only saves on printing and postage costs but also minimizes administrative expenses associated with handling and processing physical documents. The reduction in time required for processing can lead to lower overhead costs for businesses as well, presenting a business case for adopting ELR.

3. Enhanced Security

Digital systems come equipped with advanced security protocols that are not feasible with paper documents. ELR systems utilize encryption, secure access controls, and automated backups to protect sensitive information. This added layer of security is critical in combating fraud and ensuring the integrity of financial transactions.

4. Increased Accessibility

With ELR, stakeholders can access lien information from anywhere at any time, fostering a more collaborative environment for businesses, financial institutions, and consumers. This accessibility is particularly valuable for companies engaged in multiple markets or jurisdictions, allowing for seamless transactions across state lines.

5. Better Record Keeping and Data Management

Electronic systems provide improved organization and retrieval of records. Search capabilities within ELR platforms enable users to locate documents quickly and verify information in real-time, significantly reducing the likelihood of human error. Additionally, data analytics tools can provide insights into lien trends, supporting better financial decision-making.

Regulatory Changes and Adoption Challenges

Despite the clear advantages of ELR, the transition has not been without challenges. Variability in state regulations means that uniformity across the country is still a work in progress. Some jurisdictions have been slower to adopt electronic systems, requiring stakeholders to navigate a patchwork of policies and procedures. Additionally, some businesses may face initial resistance from employees accustomed to traditional methods, necessitating training and a shift in organizational culture.

The Future of Electronic Lien Recording

As technology continues to advance, the future of electronic lien recording looks promising. Blockchain technology, for instance, offers potential solutions for further enhancing security and transparency in lien recording. Smart contracts could automate many aspects of lien management, promising a new world of efficiency and integrity in financial transactions.

Moreover, as more states adopt electronic systems and as stakeholders begin to understand and appreciate the benefits, the landscape of lien recording will inevitably transition further into the digital realm. The shift from paperwork to pixels is not just a technological upgrade; it represents a commitment to modernization that aligns with the fast-paced demands of today’s economy.

Conclusion

The move towards electronic lien recording marks a critical advancement in the realm of legal and financial services. By simplifying processes, reducing costs, enhancing security, and improving accessibility, this technology is paving the way for a more efficient and reliable system for managing financial obligations. As the digital revolution continues to unfold, it is evident that embracing these innovations is essential for businesses, financial institutions, and consumers alike, ensuring a smoother future for lien management and beyond.