In our rapidly digitalizing world, industries across the spectrum are adopting technology to streamline processes, enhance efficiency, and provide better service to consumers. One of the more significant yet often overlooked transformations is happening in the realm of vehicle titles and liens, where the shift from paper-based documentation to electronic lien titles (ELTs) is revolutionizing how vehicle ownership and financing are managed.

Understanding Liens and Lien Titles

Before diving into the details of electronic lien titles, it’s important to grasp what a lien is. A lien is a legal right or interest that a lender has in a borrower’s asset, typically used as collateral to secure a debt. When a vehicle is financed, the lender usually places a lien on the vehicle title, signifying their claim until the loan is fully paid off. Traditionally, this lien information was documented on paper titles, which were then held physically by either the lender or the vehicle owner.

The Downsides of Paper-Based Systems

While the paper-based system has served its purpose for decades, it is fraught with several issues:

-

Physical Handling and Storage: Paper titles can be lost, damaged, or stolen. Retrieving a paper title requires physical access, leading to delays and potential complications in the buying or selling of vehicles.

-

Processing Delays: The transfer of lien information can be slow and cumbersome. Significant time can be wasted in processing paperwork between lenders, state departments, and vehicle owners.

- Fraud Risks: The reliance on physical documents makes the system vulnerable to forgery and fraud. Counterfeiting paper titles is a concern that has troubled financial institutions and consumers alike.

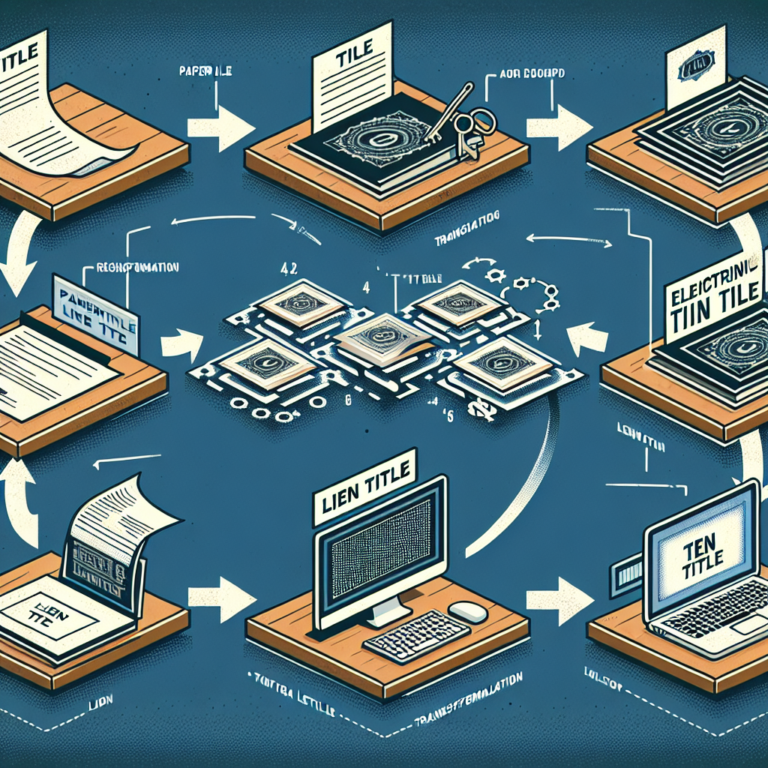

The Emergence of Electronic Lien Titles

In response to these challenges, electronic lien titles were developed. Representing a significant advancement in vehicle title management, ELTs digitize the lien process, improving efficiency and security. But what does this transition entail?

How ELTs Work

-

Digitization: An electronic lien title eliminates the need for a physical paper document. Instead, lien information is stored in a secure digital database maintained by the state’s Department of Motor Vehicles (DMV) or other relevant authority.

-

Real-Time Updates: Lenders can upload, manage, and access lien information in real-time. This feature allows for quicker access to data, facilitating smoother transactions for both lenders and borrowers.

-

Notifications and Alerts: Many electronic systems provide real-time notifications regarding the status of a lien, such as when payments are made or when a loan is paid off, improving communication between parties.

- Increased Security: Digital records can be encrypted and secured, significantly reducing the risk of fraud while providing a verified and traceable record of ownership and lien status.

Benefits of the Transition to ELTs

The shift to electronic lien titles offers numerous advantages:

-

Efficiency: The time required to process loans and transfers is drastically reduced, making transactions faster and easier.

-

Cost Savings: By minimizing paper waste and storage needs, both lenders and consumers can save money. The reduction of handling processes also lowers operational costs.

-

Improved Accuracy: Digitized records help reduce clerical errors associated with manual entry, ensuring that lien information is accurate and up-to-date.

- Enhanced Consumer Experience: Consumers benefit from faster service, as they can quickly see the status of their title and lien, enabling smoother purchasing and selling experiences.

Current Adoption Trends

As of mid-2023, a growing number of states have implemented or are in the process of transitioning to electronic lien title systems. Pilot programs have shown promising results, leading to enhanced efficiencies in vehicle title processing. Many states report reduced title-related fraud and improved overall workflow within their DMVs.

Despite these benefits, challenges remain. States unique administrative processes and differing technologies need to be standardized to ensure seamless interactions among all users within the system.

Looking Ahead: The Future of ELTs

The transition to electronic lien titles marks only the beginning of a more extensive digital transformation in the automotive industry. As technology evolves, it’s likely that additional innovations will emerge—potentially integrating with blockchain for added security and transparency, further reducing fraud risks, and improving consumer trust.

In conclusion, the move from paper to pixels in lien titles is more than just a technological upgrade; it symbolizes a shift towards a more efficient, secure, and user-friendly system that reflects the digital age we live in. As more stakeholders embrace this shift, we can anticipate a future where vehicle ownership is not only more secure but also more accessible for everyone.